ORANGE COUNTY, FL | HARD MONEY LOAN SOLUTIONS

HARD MONEY / BRIDGE LOAN SOLUTIONS FOR ORLANDO AND ALL OF ORANGE COUNTY, FL

ASSET BASED LENDING SOLUTIONS FOR THE GREATER ORLANDO, FL AREA

Orange County is the fifth most populous county in Florida and a preferred place for affordable real estate investments, but the market is fiercely competitive. Support from an experienced lender is necessary to capitalize on the best deals fast.

Hard Money Loan Solutions (HMLS) is a local lender bridging the gap between you and your favorite properties. We’re reputable and provide quick funding without bureaucratic disruptions. Whether it’s Orlando, Winter Park, or Maitland, we can help you navigate deals in top Orange County cities with ease. Contact HMLS and access funding for any housing, construction, or commercial project!

Bridge and Hard Money Loans in Orange County, Florida

Bridge and hard money loans are strategic funding products designed for time-sensitive real estate markets. Unlike regular mortgages, they’re free from extensive paperwork and hard-to-meet approval requirements.

Hard Money Loan Solutions is a 5-star rated private lender with a knack for financing real estate deals in Orange County, Florida. Our funding ideology is simple—we look at the underlying value of the asset and not your credit score, income stream, or bank balance.

At HMLS, you get customized loans, modeled in-house to fit your project and repayment strategy—we set you up with financing for:

- Purchase

- Refinance (with/without cash-out)

- New construction/reconstruction

- Rental investment

- Land development

- Fix-and-flip projects

- Owner-occupied properties

- Foreclosure/REO properties

- Unique projects

Our loans remain flexible/modifiable as per changing needs. Check out our usual lending terms for properties in Orange County:

- Property type—Any residential, commercial, or industrial property, including special structures

- Loan size—$100,000–$50,000,000+

- LTV—Up to 70%

- Tenure—Between 1 and 3 years

- Interest rates—9.99%–12%

- Rate type—Fixed

- Origination—2%

- Retainer fee—$1,500

- Amortization—No, interest-only payments

- Prepayment penalty—No (for settlements after 6 months)

We close within 3–14 days, the average time being 10 days.

Why HMLS Is the Best Orange County Hard Money Lender

Finding reliable hard money lenders in Orange County is difficult since they don’t have recognizable performance benchmarks like banks. Many lenders get a bad rap for charging exorbitant fees or canceling deals at the last minute.

At HMLS, we’re on your side from the first call. We value transparency in long-term client relationships and ensure the applicant gets an efficient and cost-effective solution working with us. Our customers never have to worry about:

- Unreasonable demands

- Hidden costs

- Funding delays

Call HMLS at (855)-244-2220 to secure your ideal mortgage product!

Real Estate in Orange County, FL—Top Market Drivers

The real estate in Orange County, FL, is influenced by the local economy and quality of life potential. Here are the top five factors that make the county a desirable place to invest in:

- Relatively low cost of living—Orange County is centrally located in Florida state and has a relatively lower cost of living than metropolises like Miami and Tampa. The cost of utilities is also lower

- Family-friendly county—Orange County cities are considered ideal for singles, couples, and families with kids. There are 300+ reputable public and private schools, especially in the Orlando area

- Low crime rate—Orange County, Florida, is safer than 71% of the counties in the U.S. and definitely the safest among the surrounding counties

- Vibrant nightlife—The county has ample entertainment opportunities thanks to live music and dance clubs, sleek lounges, comedy clubs, and swanky restaurants

- Diverse job market—Orange County’s employment potential has been growing year over year, with the best-performing industries being leisure and hospitality, business, health and education, and construction

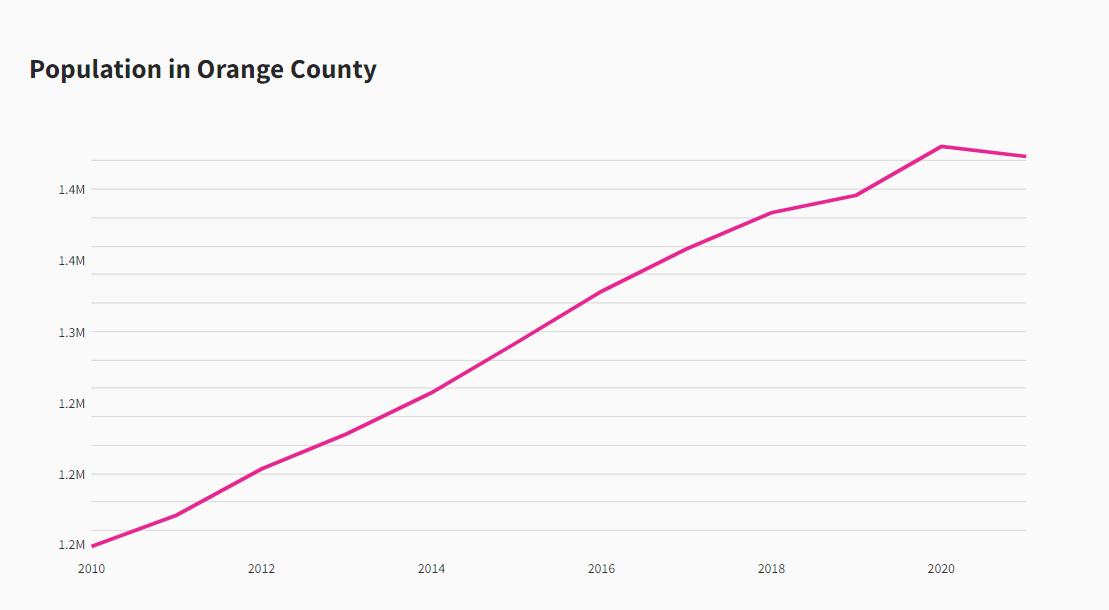

The population in the county grew roughly 24% in the past decade, so the rental and homebuyer markets have been pretty stable.

Source: USAFacts

Housing Market Statistics for Orange County, Florida

Check out what various statistics say about Florida’s Orange County housing market:

Data* | Interpretation |

8.3% increase in the median sale price of homes | The median sale price of homes in the County was $390,000 in February 2023, an 8.3% forward jump from previous-year values |

The median time to sell is 45 days | The median time to sell a home dropped from 13 days to 45 days over the past year, mainly because sellers prefer to wait around to get desired prices |

Cash offers are pretty common | Sellers in the area mostly get cash offers, which means non-cash offers or offers with sale contingencies would be unattractive. Having a cash-rich lender to back you up is important |

*Sourced from the latest figures available on Redfin

Overall, the Orange County market rewards timeliness and the right pricing. With Hard Money Loan Solutions, it’ll be easy to make cash offers of any magnitude within a week. Call our mortgage professionals at (855)-244-2220 and get funded ASAP!

Navigating Hard Money Loans in Orange County, FL—Top Real Estate Investor Groups

Besides exploring Orange County hard money loans, you may want to increase your real estate circle in the area. You can consider getting memberships to the following groups:

- West Orange Chamber of Commerce—Membership in the local chamber promotes community partnerships, bringing in many networking opportunities for real estate investors

- Central Florida Realty Investors (CFRI)—CFRI is a non-profit group that meets on the second Tuesday of each month. You can get a guest pass for your first meeting, but the membership typically starts at $75

- Orlando Real Estate Deal Finders—The group has over 1,000 members and boasts a searchable data pool of more than 10 million records

Hard Money Loan Solutions can also be a dependable networking partner for Orange County deals. Our lenders are market veterans capable of steering you in the right direction even during downturns. Ring us up at (855)-244-2220 for a free consultation!

What About Private Money Lenders Beyond Orange County, FL?

HMLS is a seasoned private lender funding deals throughout Florida. Here are some other top locations we serve:

Note: All submitted information is kept in strict confidence and used solely for the purpose of obtaining a hard money loan and/or bridge loan. We do not share your information with any third parties without your consent.

HML QUICK APPLICATION

Use our quick-start application below to begin the process. Once received, we will contact you via phone to verify your interest and to gather a few more details: