MAYO, FL | HARD MONEY LOAN SOLUTIONS

Hard Money & Bridge Financing Solutions For The Greater Mayo Area

ASSET BASED LENDING SOLUTIONS FOR THE GREATER MAYO, FL AREA

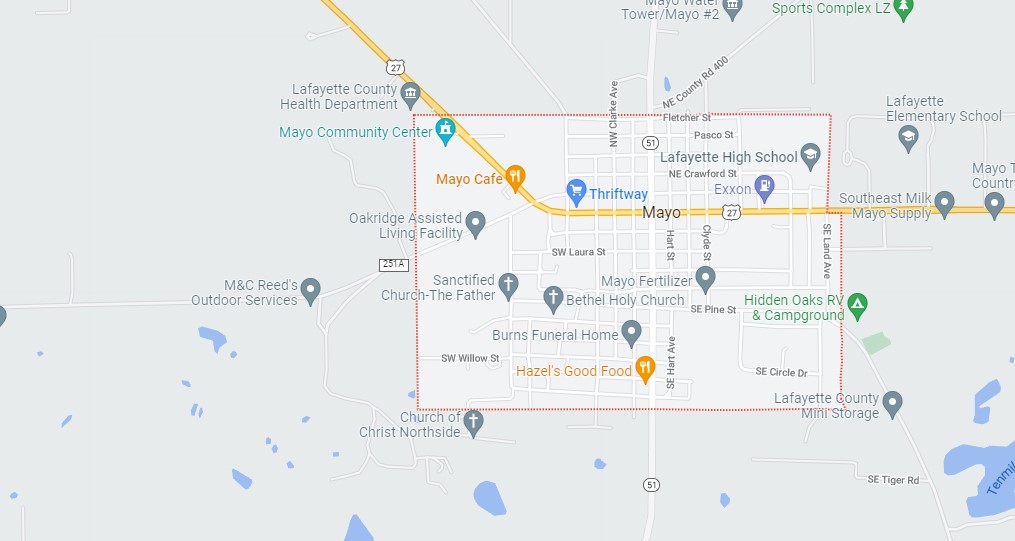

Mayo, the county seat of Lafayette County, exemplifies what it means to live in small-town America. While in Mayo, your stress level will diminish and, in some cases, may even disappear entirely if you stay for a few days. It is an excellent location to consider if you are looking to start a small business of your own.

A Streamlined Application Process for Bridge Loans in Mayo, Florida

Many lenders need loan applicants to pass through a slew of hoops before being approved for borrowing. We believe that doing so is a waste of time for your company as well as for us personally. Instead, our hard money loans are structured in such a way that the qualifying standards are reduced, and the emphasis is placed more on the property you are wanting to purchase. Here are a few of the advantages you stand to gain:

- A straightforward credit check

- Reduced cash-flow requirements

- There were only a few business documents requested.

- No external collateral requirements.

- Quick closing

- Fixed interest rates

No costly business equipment is required to be used as collateral.

No costly business equipment is required to be used as collateral. As opposed to this, the commercial property or project assets are used as collateral to secure the financing. The most important documents you must submit for approval are those that relate to the worth of the business property or the scope of the renovation project you have in mind for it. Many of our clients are able to complete their real estate transactions in as little as 7–14 days.

Loan terms and interest rates that are exceptional

We believe that promising new firms should be able to take advantage of favorable funding conditions as well. The notion that only long-established businesses should be able to obtain favorable credit rates is a fallacy. Our hard money loans enable you to qualify for fantastic terms and rates that will help you earn a profit on your first job, as well as on each and every project after that.

Loan-to-value ratio (LTV ratio): We provide a loan to value (LTV) of up to 75% of the purchase price or existing property value (whichever is lower).

Interest rates range between 10 percent to 12 percent.

Fixed-rate of interest: Our loans are amortized only on the interest earned, which ensures that the entire process is stable.

Prepayment penalties are not applicable: You have the option to pay off the loan at any moment during the term, for example, by transferring the balance to an SBA loan once you have been accepted.

No hidden fees or fine print: You will never have to worry about hidden fees or fine print. We are fully honest and straightforward about anything you need to know about us. That is one of the reasons why we are such a popular financing choice among businesses in the Mayo area.

If your company’s financials are strong, you can save money on a hard money loan. However, having strong financials is not a condition for getting accepted or enjoying favorable interest rates. We collaborate with companies across a wide range of industries.

Hard money loans and bridge loans for any type of commercial real estate project are available from a variety of lenders.

To get started, get in touch with our knowledgeable experts in Mayo, Florida, right away.

Contact us today for a free consultation and get started with a loan process that often closes within 10 days.

For super quick service, fill out the form on this page. We’ll do an immediate review, then we’ll contact you right away to begin your hard money loan or bridge financing process.

Note: All submitted information is kept in strict confidence and used solely for the purpose of obtaining a hard money loan and/or bridge loan. We do not share your information with any third parties without your consent.

HML QUICK APPLICATION

Use our quick-start application below to begin the process. Once received, we will contact you via phone to verify your interest and to gather a few more details: