BAY LAKE, FL | HARD MONEY LOAN SOLUTIONS

Hard Money & Bridge Financing Solutions For The Greater Bay Lake Area

ASSET BASED LENDING SOLUTIONS FOR THE GREATER BAY LAKE, FL AREA

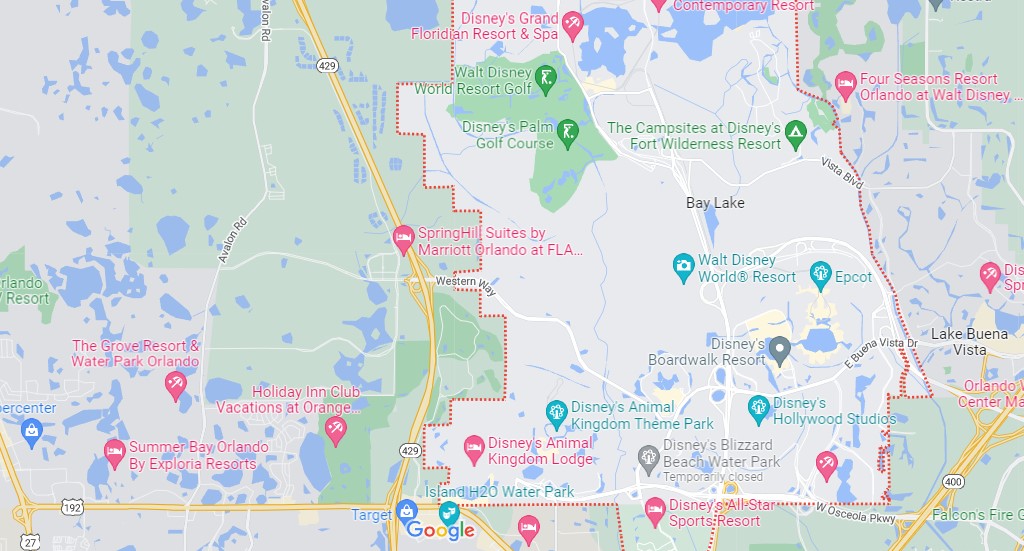

Bay Lake is a resort city located in East-central Florida, approximately 25 miles from the Atlantic Coast. It is named after a lake located east of the Magic Kingdom. Bay Lake is home to all four Walt Disney World resort theme parks and one of Walt Disney World World’s two water parks. Also, it is one of two Florida municipalities that the Walt Disney Company controls besides Lake Buena Vista.

As a Bay Lake resident, you may be looking to start a side business outside of the Walt Disney Company and for that HML Solutions can offer you the hard money loans and bridge loans needed.

Bridge Loans from HML Solutions

- Bridge loans are a type of hard money loan we lend to homeowners, real estate investors, and other entrepreneurs. This loan is a short-term funding alternative you can use to buy something or proceed with a project while awaiting more permanent financing. For instance, a bridge loan can help you remodel your property if you are a homeowner planning to sell your house soon. Similarly, you can use a bridge loan to stock up on inventory while awaiting clients’ payments, keeping your business running in the meantime. Real estate investors can also use our bridge loans to “bridge the gap” between selling a new home and buying one.

Hard Money Loans and Bridge Loans For Home Improvement

- You can consider a hard money loan, or bridge loan from HML Solutions to fund significant home remodels, especially if you intend to sell. Our bridge loans are easy to process, and you can receive your amount in one to two weeks. These loans are also short-term, lasting no more than five years since they are meant to “bridge” a temporary gap between financing.

- It is essential to note that bridge loans typically have higher interest rates than traditional financing. Consequently, it would be best to pay them off as soon as possible. Therefore, a bridge loan might not be the best solution if you plan on staying in your home after remodeling. On the other hand, a bridge loan could be just what you need if you want to improve things before selling, so keep this in mind.

How Your Business Can Benefit from Our Hard Money Loans

There is no denying that enterprises need cash to function effectively. Your business needs capital to purchase inventory that can keep it running. Additionally, you need cash to expand into unexplored territory, upgrade your equipment, and run advertising campaigns that can attract clients online and offline. Luckily, our hard money loans can help your enterprise in different ways, whether you are into retail, real estate, healthcare, or manufacturing.

For instance, if you are a real estate business, you can acquire residential loans for projects like townhomes, duplexes, apartments, and condominiums. Similarly, you can acquire commercial real estate loans to purchase or refinance properties like restaurants, self-storage facilities, and office buildings. Furthermore, you can obtain fix-and-flip loans to purchase buildings that can resell for a higher price if you remodel them successfully. Our hard money loans can also be used for office building upgrades, purchasing more company vehicles, stocking up on your inventory, and upgrading your computer systems and equipment.

Perks Of Our Hard Money and Bridge Loans

- Zero prepayment penalties or hidden fees

- Interest-only amortization

- Large loan amounts of $100,000 to $50,000,000

- Great loan-to-value (LTV) ratio of up to 75%.

- Fast closing that allows you to receive your loan in 1-2 weeks

- Flexible loan terms of 1-5 years

Contact us today for a free consultation and get started with a loan process that often closes within 10 days.

For super quick service, fill out the form on this page. We’ll do an immediate review, then we’ll contact you right away to begin your hard money loan or bridge financing process.

Note: All submitted information is kept in strict confidence and used solely for the purpose of obtaining a hard money loan and/or bridge loan. We do not share your information with any third parties without your consent.

HML QUICK APPLICATION

Use our quick-start application below to begin the process. Once received, we will contact you via phone to verify your interest and to gather a few more details: