OAKLAND, FL | HARD MONEY LOAN SOLUTIONS

Hard Money & Bridge Financing Solutions For The Greater Oakland Area

ASSET BASED LENDING SOLUTIONS FOR THE GREATER OAKLAND, FL AREA

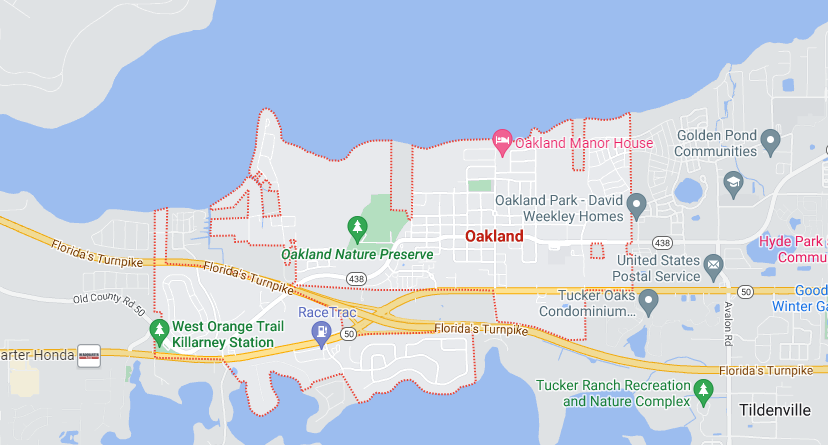

The city of Oakland is located in the central part of Florida. The city is known for its historic Oakland Manor House, its beautiful nature preserve, and the famous Oakland Art and Music Festival. Most happenings are located around the bustling streets near Lake Merritt. In addition to its festivals, it is also a business hub with many commercial tenants providing local jobs.

What Does This Mean for Oakland Business Owners?

Small businesses trying to expand their companies by buying new equipment or hiring more employees may not have all the money available from their own funds to do so. Even if a business does have enough cash reserves on hand, applying for a traditional bank loan takes time and careful planning to get approved – which most business owners don’t have when faced with growing competition in an already saturated market.

Oakland business owners can experience some relief when looking for bridge loans or hard money loans. Both types of financing are convenient because they both require less stringent requirements in terms of assets, credit history, documentation, etc. Business owners only need to meet the minimum qualifications necessary before their loan is approved.

When it comes to real estate transactions, you should understand two important terms: hard money loans and bridge financing. Here’s a look at the difference between these two types of real estate loans.

What is Bridge Financing?

Bridge financing is short-term financing that covers the time gap between an old mortgage and a new one. If you’re facing foreclosure on your current property, for example, you might not be able to qualify for another loan right away. To keep from losing your home in foreclosure, you could seek out bridge financing. This gives you the time needed to save up enough funds for closing costs or allows time for another type of loan approval after several months of on-time under the former mortgage term.

What is Hard Money?

Hard money is a type of financing that typically has high-interest rates. It’s not secured by collateral and usually can’t be obtained through traditional lending institutions, such as banks or credit unions. Instead, hard money lenders are often private investors who lend their own capital in exchange for high-interest rates because they take on additional risk when providing these loans. Due to the risks involved with this type of loan, borrowers need to have good credit ratings and large down payments in order to qualify.

What’s the difference between bridge financing and hard money? First, the short-term nature of bridge financing makes it especially useful for people who are unable to get conventional loans due to poor credit or distressed financial situations.

In addition, because it’s a short-term loan, the interest rates and fees are comparatively high. On the other hand, hard money loans can be obtained quickly and don’t need to undergo an extensive underwriting process because the lenders accept more risk due to their unsecured nature.

The Benefits of Working with A Licensed Broker

When looking for a bridge loan or hard money loan, it is important that you work with an experienced and honest broker. You want someone who will listen to your needs and help you find the best lender specifically for your company’s circumstances instead of trying to fit you into a package deal where your situation may not be appropriate.

Hard Money Loans Solutions Are Here to Help!

At Hard Money Loans Solutions, we have helped dozens of Oakland businesses find the financing they need. We partner with top lenders and brokers across the nation to ensure our clients get fast approvals, competitive rates, and long-term terms.

When you work with us, we can help answer any of your questions about these types of loans and finance.

Contact us today for a free consultation and get started with a loan process that often closes within 10 days.

For super quick service, fill out the form on this page. We’ll do an immediate review, then we’ll contact you right away to begin your hard money loan or bridge financing process.

Note: All submitted information is kept in strict confidence and used solely for the purpose of obtaining a hard money loan and/or bridge loan. We do not share your information with any third parties without your consent.

HML QUICK APPLICATION

Use our quick-start application below to begin the process. Once received, we will contact you via phone to verify your interest and to gather a few more details: